We help you to

get into Quant

Global Quant Trading Career Program,

2026 Summer Cohort

Certified Quant Training & Winter Analyst Training Program

Application Open Now!

Early Bird Deadline: 31st Feb 2026

The Quant Career Program is now available in the US, UK, Hong Kong, Paris, Canada, Australia, Singapore, India and South Korea.

Global Quant Trading Career Program,

2026 Spring Cohort

Certified Quant Training & Winter Analyst Training Program

Enrolment Procedure

The Quant Program is designed for top-performing university students and graduates. Applicants undergo a rigorous screening process to assess their programming and mathematical proficiency before acceptance.

Program Intake: 30

1

Apply

2

Attend the

virtual briefing

3

Ennrol in

the program

2

Attend the

virtual briefing

3

Ennrol in

the program

Certified by QDA (UK)® After Completing Quant Training

QDA(UK)®Certification is based in United Kingdom and is the Accredited Certification Institute for Tech Training Courses, Quant Course, Quantitative Course Worldwide. QDA, which stands for Quality Development Assurance, is a framework designed to ensure the ongoing development and assurance of professional quality within various fields. QDA emphasizes the importance of continuous learning and skill development to foster excellence throughout one's career journey.

.png)

Where Our Students Work

"During my time at the Academy, I’ve also been able to learn at my own pace and time. Personally, I would recommend the Academy to anyone who is serious about trying to break into quant finance industry."

Ian Austines

Trading Analyst, Glencore

"Overall, the lessons have been very useful to me as they’re made to specifically cater to a quant speciality. "

Golam Mostafa Uday

Quant Analyst, Natixis

"The Academy has been a pivotal chapter in my professional development as a valuation analyst for equity derivatives at GTJA International. Its comprehensive curriculum—covering market microstructure, trading strategies, risk assessment with relative and absolute VaR, monetary policy insights, and hands-on coding—has armed me with the skills to thrive in my role and set my sights on future growth."

Eric Tai

GYJA International

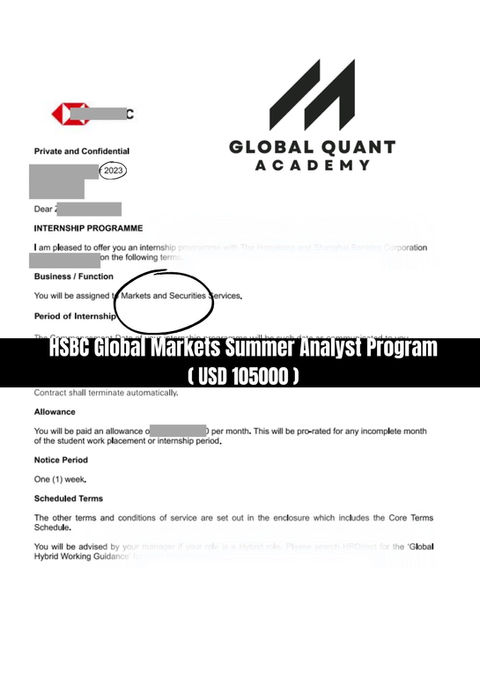

Job Opportunities By Leading Institutions Like

Where Our Students Work

"During my time at the Academy, I’ve also been able to learn at my own pace and time. Personally, I would recommend the Academy to anyone who is serious about trying to break into quant finance industry."

Ian Austines

Trading Analyst, Glencore

"Overall, the lessons have been very useful to me as they’re made to specifically cater to a quant speciality. "

Golam Mostafa Uday

Quant Analyst, Natixis

"The Academy has been a pivotal chapter in my professional development as a valuation analyst for equity derivatives at GTJA International. Its comprehensive curriculum—covering market microstructure, trading strategies, risk assessment with relative and absolute VaR, monetary policy insights, and hands-on coding—has armed me with the skills to thrive in my role and set my sights on future growth."

Eric Tai

GYJA International

Learning Quant Opens More Doors For Your Future Career

The Global Quant Trading Career Program, Designed by Hedge Fund Quants

As Co-Founder and Program Director of Global Quant Academy, Henry combines academic excellence with real-world expertise to mentor students. He holds a Master’s in Statistics, a dual major in Computer Science & Mathematics, and won a Silver Medal at the International Physics Olympiad (2014).

Professionally, he has worked in Cash Equity Algorithmic Trading at Credit Suisse as a Quant Researcher and Developer, and later as a Quantitative Strategist at a hedge fund specializing in Fixed Income, Rates, and FX. His expertise includes intraday predictive models, equity market microstructure, and global rates strategies, with a deep end-to-end understanding of hedge fund and algorithmic trading operations. He has also received offers from leading firms such as Citadel, Goldman Sachs, and Bank of America Merrill Lynch.

Before focusing on finance, Henry studied Physics and Mechanical Engineering, interned at Cisco, conducted research in quantum optics and machine learning, and joined a Microsoft partnership program. With a lifelong passion for teaching, he has been designing and leading training programs since high school, bringing broad experience and commitment to student mentorship.

Henry, a former Credit Suisse quant and hedge fund strategist, has mentored over 500 students pursuing careers in quantitative finance.

.png)

James is a seasoned quantitative finance professional who currently works as a Quantitative Analyst at a New York-based discretionary macro hedge fund managing over $2 billion USD in assets.

He previously spent nearly three years as Assistant Portfolio Manager at Millennium and held roles as Quantitative Analyst in both New York and Hong Kong, specializing in systematic macro strategies.

Earlier in his career, James worked as a Market Making Strategist at Goldman Sachs in London and began as a full stack Software Engineer at Cisco in the United States. In addition to his industry experience, James is also the co-founder of Global Quant Academy—a specialist quantitative finance training institution that shares a mission similar to Asia Quant Academy, advancing quantitative investment expertise in the region.

From Learning to Landing: Your Quant Career Journey

Certified Quant Training Program

Guided & Interactive

Lectures

Assignments

Remote Learning

Certification by QDA(UK)®Certification

Program Period: 12 May 2026 to 18th july 2026

(Lectures: TUE 10:00am-11:30am & THU 10-11:30am)*GMT+8

Learn 6 Modules in 30 Hours:

✓ Investment Banks & Hedge Fund Overview:

Introduction to the pivotal roles of investment banks and hedge funds in financial markets.

✓ Types of Buy-Side Firms:

Exploring various buy-side entities including mutual funds, pension funds, hedge funds and private equity firms.

✓ What is Quant & Quant Trader:

Defining quantitative trading and outlining the responsibilities and functions of different types of quant.

✓ Career, Compensation & Companies:

Discussing career paths, compensation expectations, and identifying key players in the quant trading landscape.

✓ Knowledge Map: Math:

Connecting university-level mathematics to practical applications in quantitative finance.

✓ Knowledge Map: Computer Science:

Showing how computer science courses in university are integral to developing trading algorithms and systems.

✓ Knowledge Map: Finance & Economics:

Relating academic economic and financial theory to the strategies and analyses used by quants and quant traders.

6 hours

Demo Lecture - Implementation Shortfall

Mentorship from Founders Of Global Hedge Funds and Trading Boutiques

Partner (Asset Management)

Partner (Asset Management)

Upon completion of the program, students receive a personalized reference letter issued by their supervisor, which can be used to support background checks for future applications.

%20-Sheldon%20Pan_pdf%20(2).jpg)

"I’ve signed an offer with Goldman Sachs Strats. The Global Quant Academy sessions made complex math-heavy concepts much more approachable, and the guidance on interview strategies helped me stand out from the competition."

Michael

Offers: Goldman Sachs (Strats)

"Programming questions always tripped me up before. The coding drills and real interview walkthroughs gave me so much confidence. Now I’m heading into my internship with Two Sigma."

David

Offers: Two Sigma

"GQA program that makes me more competitive on the job market..."

Rachel

Offers: Citadel

"I was completely lost with how to approach quant applications. After joining the program, I not only refined my technical answers but also learned how to tell my story effectively. Ended up with 4 interview invites in just two weeks."

"How these knowledges can apply or can be used in financial context.."

David

Offers: Two Sigma

"Hi, I'm Fred, an engineering student with strong programming skills but no career direction until I found quant trading. I joined Asia Quant Academy's 2023 Summer Global Quant Trading Career Program, which enhanced my financial knowledge, market sense, and interview confidence. Henry's clear teaching of complex quant concepts helped me excel. I received a quant offer from Deutsche Bank and highly recommend this program to STEM students entering trading."

"Everything basics of finance to the advanced quant trading strategies..."

"Everything basics of finance to the advanced quant trading strategies..."

Endorsed By Students Worldwide

_edited.jpg)

Endorsed By Students Worldwide

_edited.jpg)

"I would recommend GQA to anyone who is serious about trying to Quant Finance industry..."

"How these knowledges can apply or can be used in financial context.."

"Everything basics of finance to the advanced quant trading strategies..."

"GQA program that makes me more competitive on the job market..."

"I would recommend AQA to anyone who is serious about trying to Quant Finance industry..."

"I would recommend AQA to anyone who is serious about trying to Quant Finance industry..."

Enrolment Procedure

The Quant Program is designed for top-performing university students and graduates. Applicants undergo a rigorous screening process to assess their programming and mathematical proficiency before acceptance.

Program Intake: 30

1

Apply

2

Attend the

virtual briefing

3

Ennrol in

the program

_edited.png)

.png)